can you pawn a car title without insurance

Can you pawn a car title without insurance?

Many people wonder if it is possible to pawn a car title without insurance. It can be a confusing topic, but we're here to help clarify things.

1. Can I pawn my car title without insurance?

NLP Answer: No, pawning a car title without insurance is generally not possible.

Comprehensive Answer: When it comes to pawning a car title, insurance coverage is an essential aspect. Most pawnshops require you to have insurance on the vehicle before they are willing to accept the car title as collateral. Insurance provides protection for both the pawnshop and the borrower in case of any damage, loss, or liability related to the vehicle. It ensures that there is compensation available in case of accidents, theft, or other unfortunate events. Without insurance, the risk for the pawnshop is significantly higher, making it unlikely for them to accept the car title as collateral.

Additional Information:

- Having comprehensive and collision coverage is usually necessary for pawning a car title.

- Pawnshops may ask for proof of insurance before allowing you to pawn a car title.

- Insurance also protects the borrower in case the vehicle is damaged or stolen while in the possession of the pawnshop.

2. Do I need insurance to pawn a car title?

NLP Answer: Yes, insurance is typically required to pawn a car title.

Comprehensive Answer: Most pawnshops require borrowers to have insurance coverage on the vehicle in order to pawn the car title. Insurance provides a level of security for the pawnshop, ensuring that there is financial protection in case of any incidents or accidents involving the vehicle. It also protects the borrower from potential liabilities. Pawnshops want to minimize their risk and ensure that they can recover their investment in case of any unforeseen events. Therefore, having insurance is an important requirement to pawn a car title at most pawnshops.

Additional Information:

- Pawnshops may ask for proof of insurance before accepting a car title as collateral.

- Insurance coverage typically includes comprehensive and collision coverage.

- Insurance protects both the pawnshop and the borrower in case of any damages or losses related to the vehicle.

3. What happens if I pawn a car title without insurance?

NLP Answer: Pawning a car title without insurance may not be allowed or may result in a higher rate.

Comprehensive Answer: Pawning a car title without insurance can have various consequences. Some pawnshops may not allow you to pawn a car title without insurance, as it represents a higher risk for them. If a pawnshop does accept a car title without insurance, they may charge a higher interest rate or fees to compensate for the increased risk. It's important to note that the specific policies regarding insurance requirements vary between pawnshops, so it's best to check with the pawnshop directly to understand their guidelines.

Additional Information:

- Some pawnshops may have specific insurance requirements for pawning a car title.

- Pawning a car title without insurance may result in higher costs for the borrower.

- Insurance provides protection for both the pawnshop and the borrower in case of any incidents involving the vehicle.

4. Is car insurance mandatory for pawning a car title?

NLP Answer: Car insurance is typically mandatory for pawning a car title.

Comprehensive Answer: In most cases, car insurance is mandatory for pawning a car title. Pawnshops require insurance coverage as it provides protection for their investment in case of any damages, accidents, or theft involving the vehicle. Insurance coverage reduces the risk for both the pawnshop and the borrower, ensuring that financial compensation is available in case of any unfortunate events. Pawnshops want to minimize their risk and protect their interests, making car insurance a mandatory requirement for pawning a car title.

Additional Information:

- Having comprehensive and collision coverage is typically necessary for pawning a car title.

- Proof of insurance may be required by pawnshops before accepting a car title as collateral.

- Car insurance provides financial protection for both the pawnshop and the borrower.

5. What are the risks of pawning a car title without insurance?

NLP Answer: Pawning a car title without insurance can result in a higher risk for the pawnshop.

Comprehensive Answer: Pawning a car title without insurance poses risks for both the pawnshop and the borrower. Without insurance coverage, the pawnshop is more exposed to financial liabilities in case of any damages, accidents, or theft involving the vehicle. This can increase the risk for the pawnshop and may lead to potential losses if an unfortunate event occurs. Additionally, the borrower may also be at risk as they may not receive compensation for any damages or losses related to the vehicle if insurance is not in place. It is generally advisable to have insurance when pawning a car title to mitigate potential risks.

Additional Information:

- Insurance provides financial protection in case of accidents, damages, or theft involving the vehicle.

- Without insurance, the pawnshop may not be able to recover their investment in case of loss or damage to the vehicle.

- The borrower may be left without compensation for any damages or losses if insurance is not in place.

6. Are there any alternatives to pawning a car title without insurance?

NLP Answer: Yes, there may be alternative options available if you don't have insurance to pawn a car title.

Comprehensive Answer: If you don't have insurance to pawn a car title, there may be alternative options to consider. You can explore other types of loans or financing options that don't require insurance, such as personal loans or secured loans using other types of collateral. Additionally, you may also consider obtaining insurance coverage for the vehicle before attempting to pawn the car title. It's important to explore different options and carefully assess the terms, conditions, and requirements before making a decision.

Additional Information:

- Personal loans or secured loans using alternative collateral may be options if you don't have insurance.

- Obtaining insurance coverage for the vehicle can make it eligible for pawning the car title.

- Research and compare different loan options and insurance providers to find the best solution for your specific situation.

7. How can I get insurance for a vehicle to pawn a car title?

NLP Answer: To get insurance for a vehicle, you can contact insurance providers and inquire about coverage options.

Comprehensive Answer: Getting insurance for a vehicle can be done by contacting insurance providers and exploring coverage options. You can start by reaching out to different insurance companies and requesting quotes for insurance coverage for your specific vehicle. It's important to provide accurate information about the vehicle, its usage, and any additional requirements you may have. You can compare the quotes, coverage options, and premiums offered by different insurance providers to find the best solution for your needs. Once you have obtained insurance coverage, you can proceed with pawning the car title.

Additional Information:

- Contact insurance providers to request quotes for coverage on your vehicle.

- Provide accurate information about the vehicle and any specific requirements you may have.

- Compare quotes, coverage options, and premiums from different insurance providers.

- Ensure the insurance coverage meets the requirements of the pawnshop before proceeding with pawning the car title.

8. Can I pawn a car title with just liability insurance?

NLP Answer: Pawning a car title with just liability insurance may vary depending on the pawnshop's requirements.

Comprehensive Answer: The acceptability of pawning a car title with just liability insurance may vary between pawnshops. While liability insurance may meet the minimum legal requirements for driving, it may not provide sufficient coverage to protect the interest of the pawnshop and the borrower in case of damages, accidents, or theft involving the vehicle. Pawnshops often require comprehensive and collision coverage, which go beyond liability insurance. It's recommended to check with the specific pawnshop regarding their insurance requirements before attempting to pawn a car title with just liability insurance.

Additional Information:

- Pawnshops may require comprehensive and collision coverage in addition to liability insurance.

- Liability insurance generally covers damages or injuries caused to others in an accident, but may not cover damages to the insured vehicle.

- It's advisable to check with the pawnshop regarding their specific insurance requirements before proceeding.

9. Can I pawn a car title with expired insurance?

NLP Answer: Pawning a car title with expired insurance may not be accepted by pawnshops.

Comprehensive Answer: Pawnshops generally require insurance coverage to be active and up to date when pawning a car title. Having expired insurance means that there is no current coverage for the vehicle, which increases the risk for the pawnshop and the borrower. Without active insurance, the pawnshop may not be willing to accept the car title as collateral or may charge higher rates or fees to compensate for the increased risk. It's crucial to ensure that the insurance coverage is active and not expired before attempting to pawn a car title.

Additional Information:

- Expired insurance means that there is no current coverage for the vehicle.

- Pawnshops generally require insurance coverage to be active and up to date.

- Lack of insurance may result in the pawnshop not accepting the car title as collateral or charging higher rates/fees.

10. What other documents do I need to pawn a car title?

NLP Answer: Other required documents may include identification, vehicle registration, and proof of ownership.

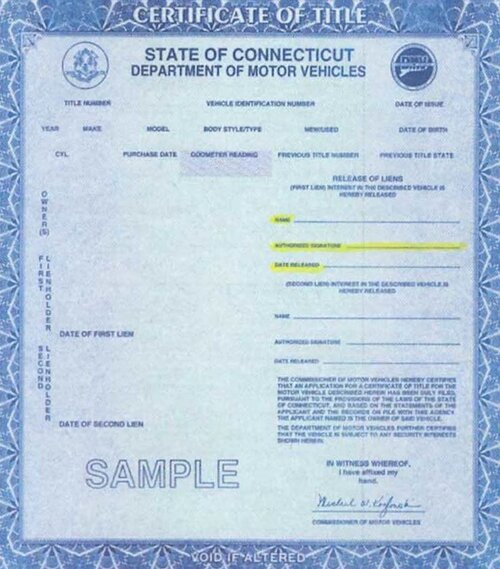

Comprehensive Answer: In addition to insurance, there are other documents you may need to pawn a car title. These documents typically include a valid identification document, such as a driver's license or passport, proof of ownership of the vehicle, such as the vehicle title or registration certificate, and any other documents required by the specific pawnshop. It's recommended to contact the pawnshop directly or visit their website to find out the exact requirements for pawning a car title, as these may vary between pawnshops.

Additional Information:

- Other documents may include proof of residence, income, or other identification documents.

- Specific requirements vary between pawnshops, so it's best to check with the pawnshop directly.

- Prepare all necessary documents in advance to streamline the pawn process.

11. Can I pawn a car title if the vehicle is not paid off?

NLP Answer: Pawning a car title with an outstanding loan may vary depending on the pawnshop's policies.

Comprehensive Answer: Pawning a car title with an outstanding loan or if the vehicle is not fully paid off may vary between pawnshops. Some pawnshops may allow you to pawn the car title even if there is an existing loan or a lien on the vehicle, while others may require the loan to be paid off before accepting the car title as collateral. It's crucial to communicate with the pawnshop directly and understand their specific policies regarding pawning a car title with an outstanding loan. Additionally, other factors such as the value of the vehicle and the loan balance may also be taken into consideration.

Additional Information:

- Check with the pawnshop regarding their policies on pawning a car title with an outstanding loan.

- Some pawnshops may accept the car title as collateral even with an existing loan, while others may require the loan to be paid off.

- Factors such as the vehicle's value and the loan balance may also be considered in the decision-making process.

12. What happens if I don't repay the pawn loan after pawning a car title?

NLP Answer: If you don't repay the pawn loan, the pawnshop may take possession of the vehicle.

Comprehensive Answer: Failing to repay the pawn loan after pawning a car title can result in the pawnshop taking possession of the vehicle. When you pawn a car title, you are essentially using the car as collateral for the loan. If you don't repay the loan within the agreed-upon terms, which typically include the principal loan amount plus interest and fees, the pawnshop has the right to sell the vehicle to recover their investment. It's important to carefully consider the repayment terms and ensure that you have the means to repay the loan before pawning a car title.

Additional Information:

- Defaulting on the pawn loan may result in the pawnshop selling the vehicle to recoup their investment.

- Review the loan terms, including the repayment schedule, interest rate, and fees, to ensure you can meet the obligations.

- Avoid defaulting on the loan by planning and budgeting accordingly.